Calculate my after tax income

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Youll then see an estimate.

Annual Income Calculator

How to Increase a Take Home Paycheck.

. Youll then get a breakdown of your total tax liability and take-home. Now lets see more details about how weve gotten this monthly take. If your salary is 40000 then after tax and national insurance you will be left with 30879.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. Your average tax rate is. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. See your tax refund estimate.

If youve already paid more than what you will owe in taxes youll likely receive a refund. Annual Income 15hour x 40 hoursweek x 52 weeksyear Annual Income 31200 Your annual income would be 31200. Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings.

This is a break-down of how your after tax take-home pay is calculated on your 65000 yearly income. This means for an annual. TDS advance tax and self-assessment tax payments.

Your income after tax Medicare levy. Earnings from various modes in a financial year subject to income tax for the whole year is treated as income after tax. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted.

Well calculate the difference on what you owe and what youve paid. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Using the annual income formula the calculation would be.

These taxes together are called FICA taxes. If you make 65000 a year living in the region of Arkansas USA you will be taxed 10992. Your average tax rate is 1121 and your marginal.

Your average tax rate is 220 and your marginal tax rate is 353. Federal Income Tax Calculator Calculate your federal state local taxes Updated for 2022 tax year on Aug 31 2022. The easiest way to achieve a salary increase may be to simply ask for a raise promotion or bonus.

These are levied not only in the income of residents. Determine your Tax Obligation. Yes you can use specially formatted urls to automatically apply variables and auto-calculate.

If you make 52000 a year living in the region of Ontario Canada. Arkansas Income Tax Calculator 2021. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Use our free income tax calculator to work out how much tax you should be paying in Australia. Ad Partner with Aprio to claim valuable RD tax credits with confidence. Use the income tax bracket rate during FY 2022-23 to determine the annual tax bill.

Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. There are various components of after-tax income. For instance an increase of.

This means that after tax you will take home 2573 every month or 594 per week. However this is assuming that. Income qnumber required This is required for the link to work.

It can be any hourly weekly or. Aprio performs hundreds of RD Tax Credit studies each year. Your marginal tax rate.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

Excel Formula Income Tax Bracket Calculation Exceljet

Salary Formula Calculate Salary Calculator Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Net Income Formula And Examples Bench Accounting

Taxable Income Formula Calculator Examples With Excel Template

How Is Taxable Income Calculated How To Calculate Tax Liability

Taxable Income Formula Examples How To Calculate Taxable Income

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Net Pay Step By Step Example

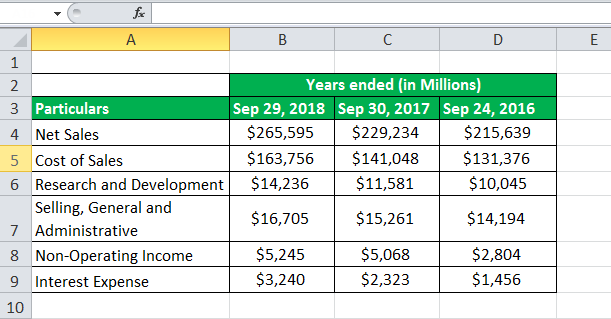

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

How To Calculate Income Tax In Excel

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template